Unified MPF Branding

& Integration

Sun Life Financial, one of the leading global financial services companies, administers MPF (Mandatory Provident Fund) services in Hong Kong through its subsidiary BestServe Financial Limited.

Role:

- UX/UI Designer

Contribution:

- Brand transition

- Usability testing

- MPF scheme iteration

- Visual design

Platform:

- Mobile app iOS and Android

Timeline:

- 1 month

Introduction

BestServe MPF refers to the Mandatory Provident Fund (MPF) services offered by Sun Life Financial through its subsidiary, BestServe Financial Limited. BestServe has become a leading player in Hong Kong's retirement market, offering MPF services to employees, employers, and the

self-employed.

The initiative aimed to modernize the brand, reflecting its digital-first approach, integrating with Sun Life's brand, and addressing the growing demand for accessible, easy-to-use retirement solutions.

My role

I'm one of the UX designers who support this project. Through research, testing, and design, I collaborated with this cross-functional team

based in Hong Kong.

Natalie Lau (Brand & Marketing Director)

Matt Kwan Yu (Business Development Manager)

Kevin Wei (Product Manager)

- Hubert Wong (Sr. UX Designer)

- Tiffany Cheung (Researcher)

- Jaisy Lu (Software Engineer)

Understanding the problem

Before the rebranding, BestServe MPF operated under a separate identity from Sun Life’s broader global brand. Among customers who interacted with Sun Life’s other services but had to navigate a different experience when managing their MPF accounts.

Problem 1.

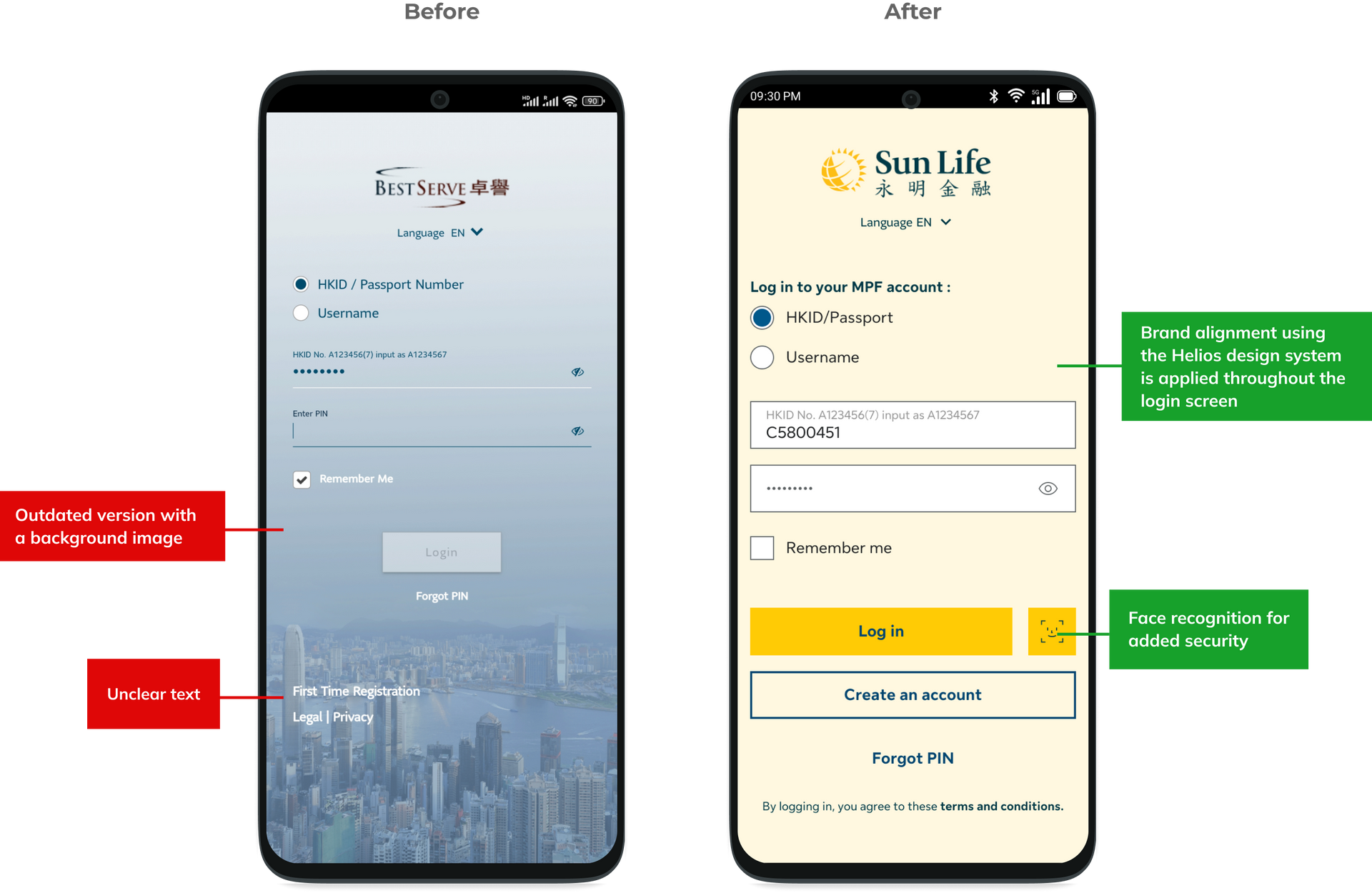

Authentication and security

The platform relied on

password-based login. This system was outdated and inadequate in providing security for sensitive financial data.

Impact

Lacked modern security measures, such as biometric login (Face ID, fingerprint), leaving user data vulnerable to unauthorized access.

Problem 2.

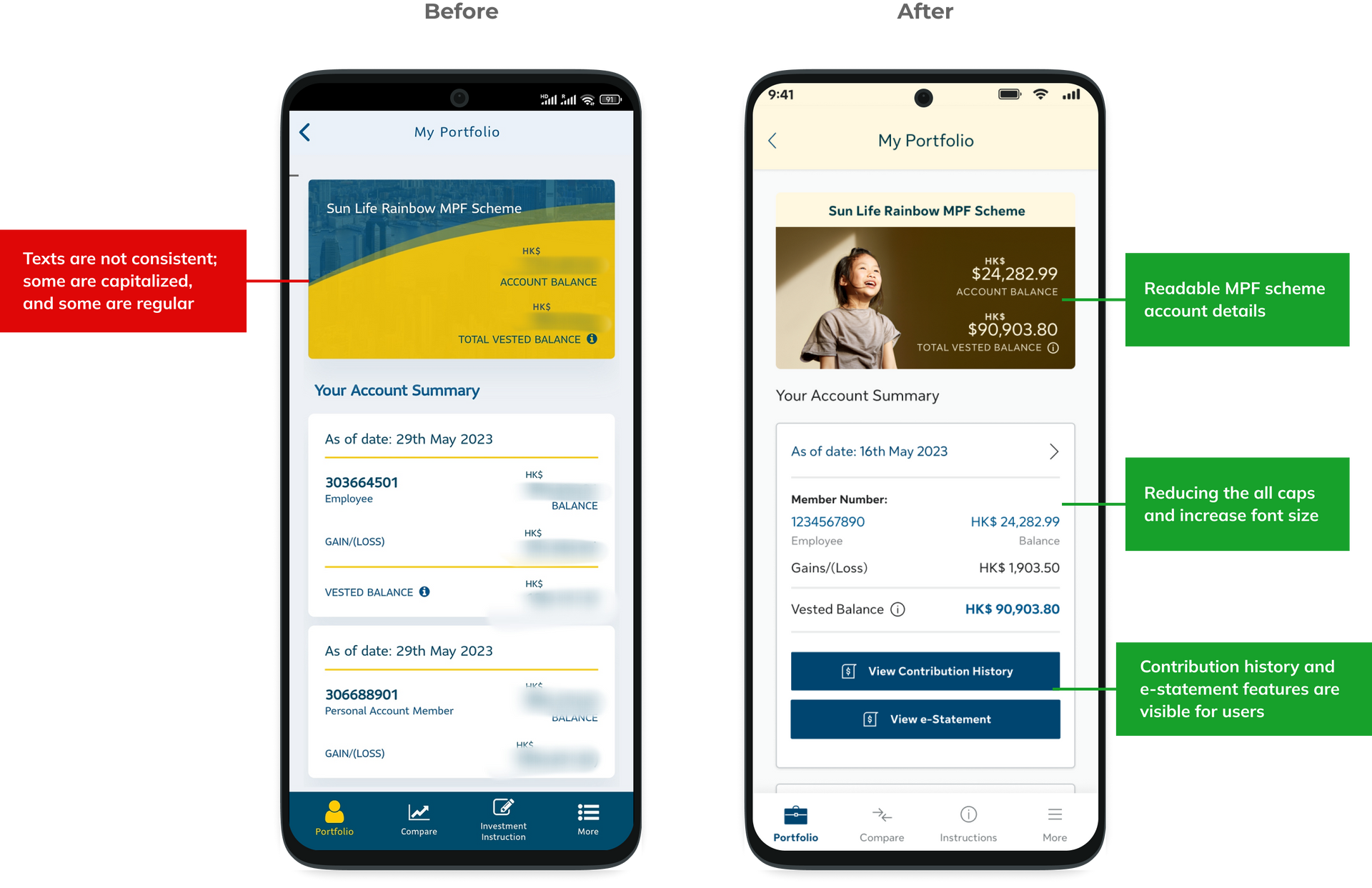

Outdated brand identity

The mobile app interface was outdated, with nested menus and a disorganized layout.

Impact

The card section lacks an indicator or chevron to display other available MPF schemes, which leads to the user's confusion.

Problem 3.

Transparency and controls

Users had no visibility into the status of their fund switching or mandate change requests, leaving them with little control over their MPF accounts.

Impact

Lack of real-time updates on pending transactions or fund switching requests, leading to confusion and frustration.

Defining the problem

"How might we rebrand BestServe MPF to create a seamless, user-friendly digital experience and boost user engagement?"

Goals

Business Goals:

Strengthen brand recognition

Align BestServe MPF with Sun Life’s global brand to create a cohesive identity across all of Sun Life’s services, fostering brand recognition and trust.

Drive market leadership

Improved market share and client acquisition, particularly among tech-savvy users who demand seamless digital solutions.

Operational efficiency

Reduced operational costs and improved customer service efficiency by enabling self-service options and reducing the amount of work for customer support.

User Goals:

Transition to digital-first experience

A quicker, more convenient experience and less dependence on conventional customer support channels translate into higher user satisfaction.

Secure and convenient

log-in

Improved security and user trust, with faster and more secure login options.

Simplify and Enhance user experience

A mobile-friendly interface that allows them to manage their MPF accounts, track their investments, and make changes with assurance.

Impact

Sun Life MPF saw a rise in new client sign-ups by providing an enhanced digital experience and aligning with Sun Life's global brand. Over eight months, this helped to increase market share by 15%.

40%

Increase in active users

The improved user experience, mobile-first design, and better brand recognition were significant factors in driving this growth.

30%

Increase in brand recognition

This improvement was primarily due to the platform's alignment with Sun Life's established global reputation.

35%

Increase in user engagement

Features such as real-time tracking, self-service updates, and a mobile-optimized interface made the platform easier to use, resulting in increased activity and interaction.

90%

User satisfaction rate

The transparency and control provided by these features significantly boosted overall user satisfaction.

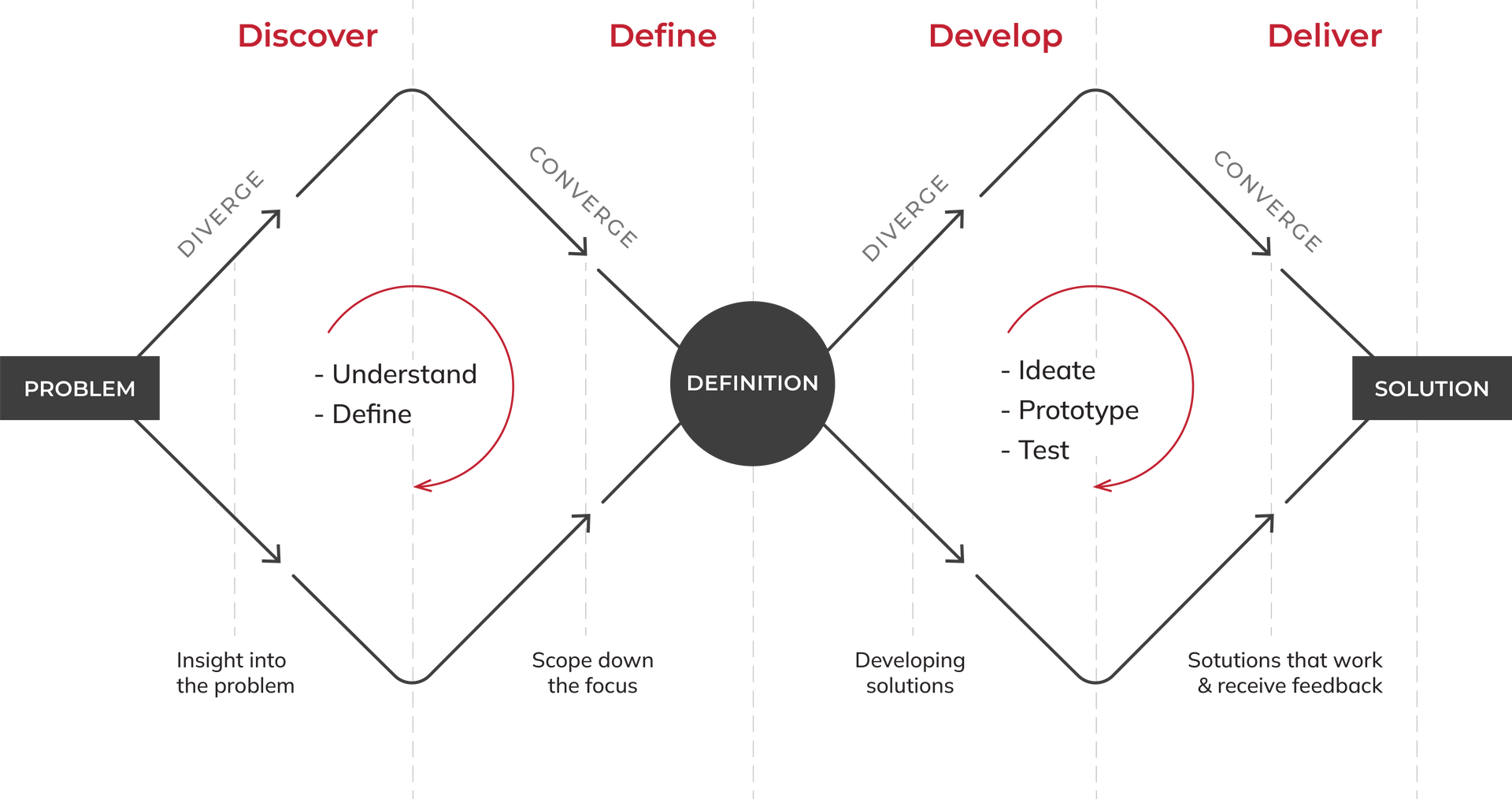

Our process

Our process is based on the Double Diamond design framework. We aim to incorporate the key phases of Discovery, Definition, Development, and Delivery in all of our projects.

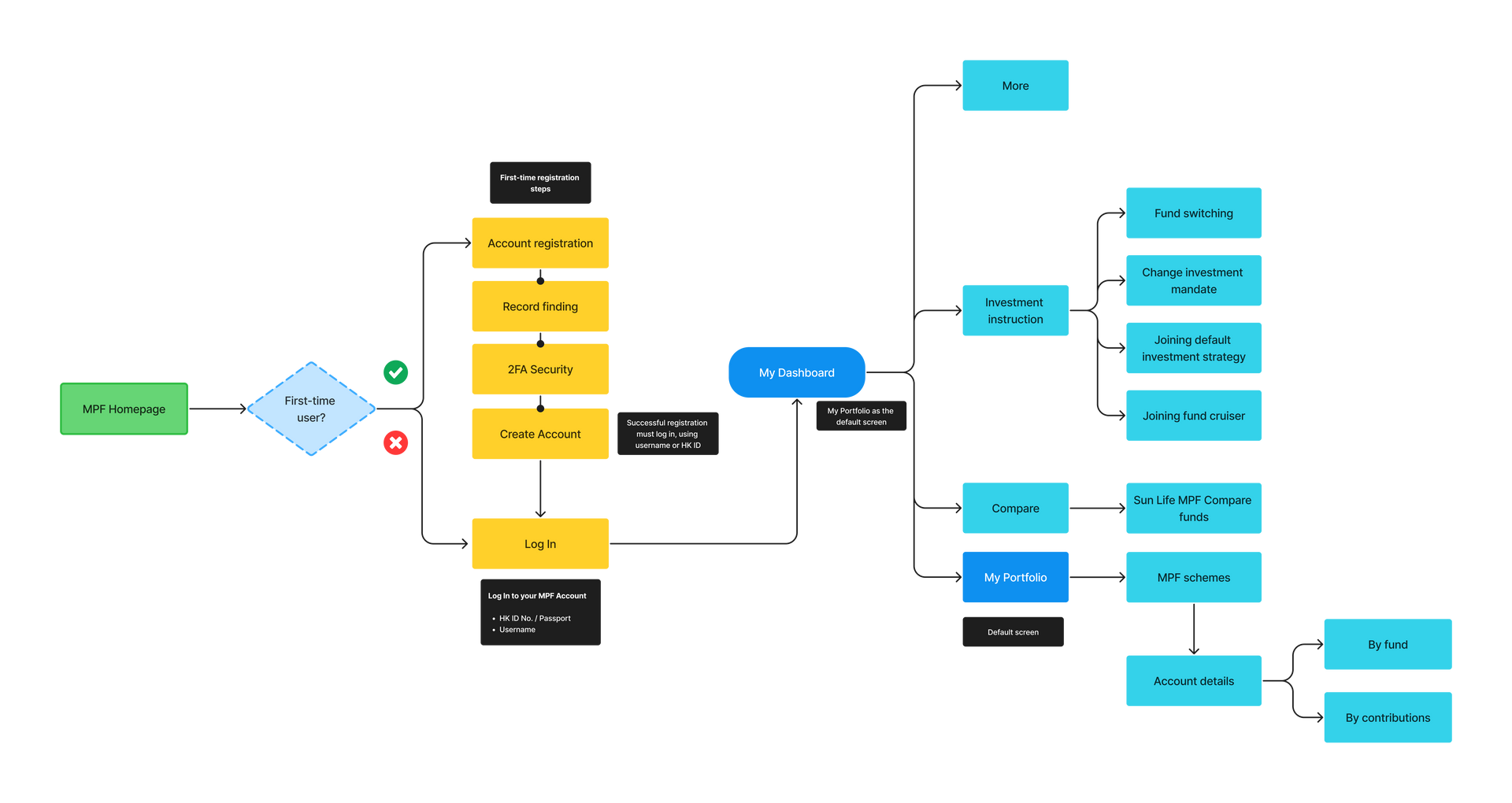

User flow

We mapped each flow to its journey on the app, with its respective success metrics.

High-level design

We use Helios Design System as the core brand identity of Sun Life. This focuses on core functionality, including brand alignment, MPF scheme iteration, and product features, which are essential for enhancing the user experience while aligning with Sun Life’s global branding.

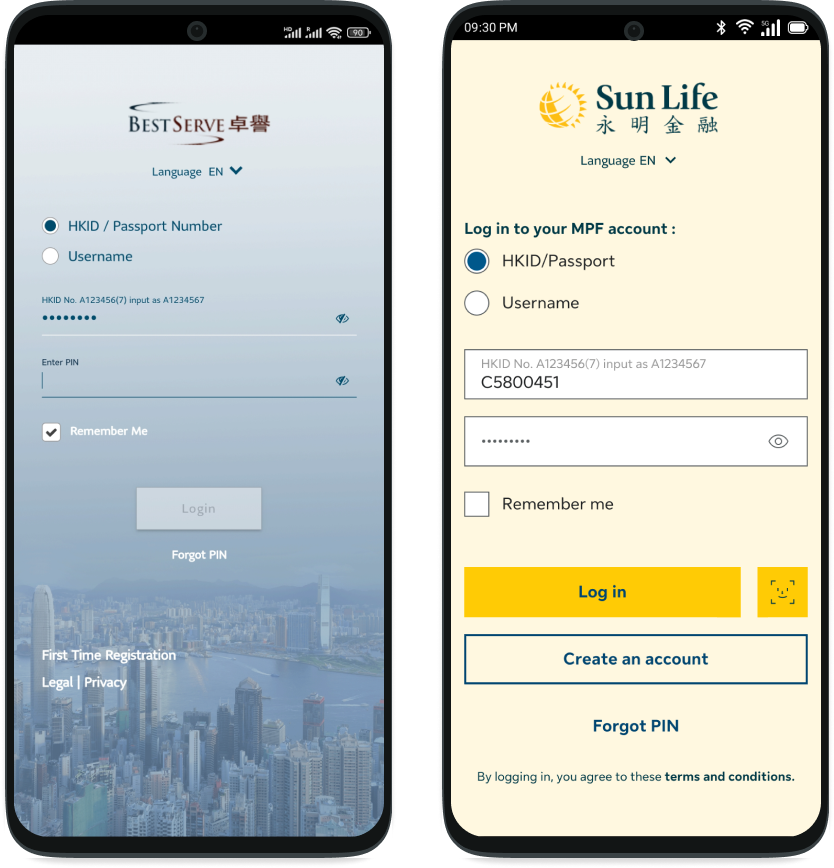

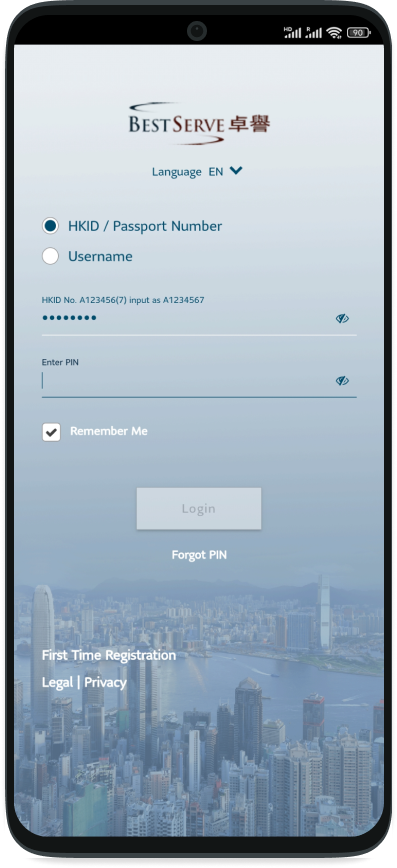

Log In

The login process is now streamlined with biometric authentication, Face ID, providing enhanced security and a seamless login experience.

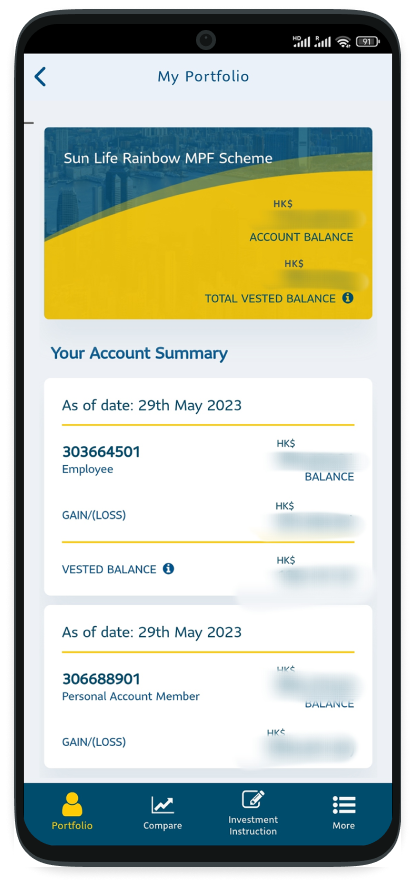

My Portfolio

The portfolio overview is now cleaner and more user-friendly, featuring a mobile-optimized design with clear sections for account balances, investment returns, and MPF schemes, providing instant insights at a glance.

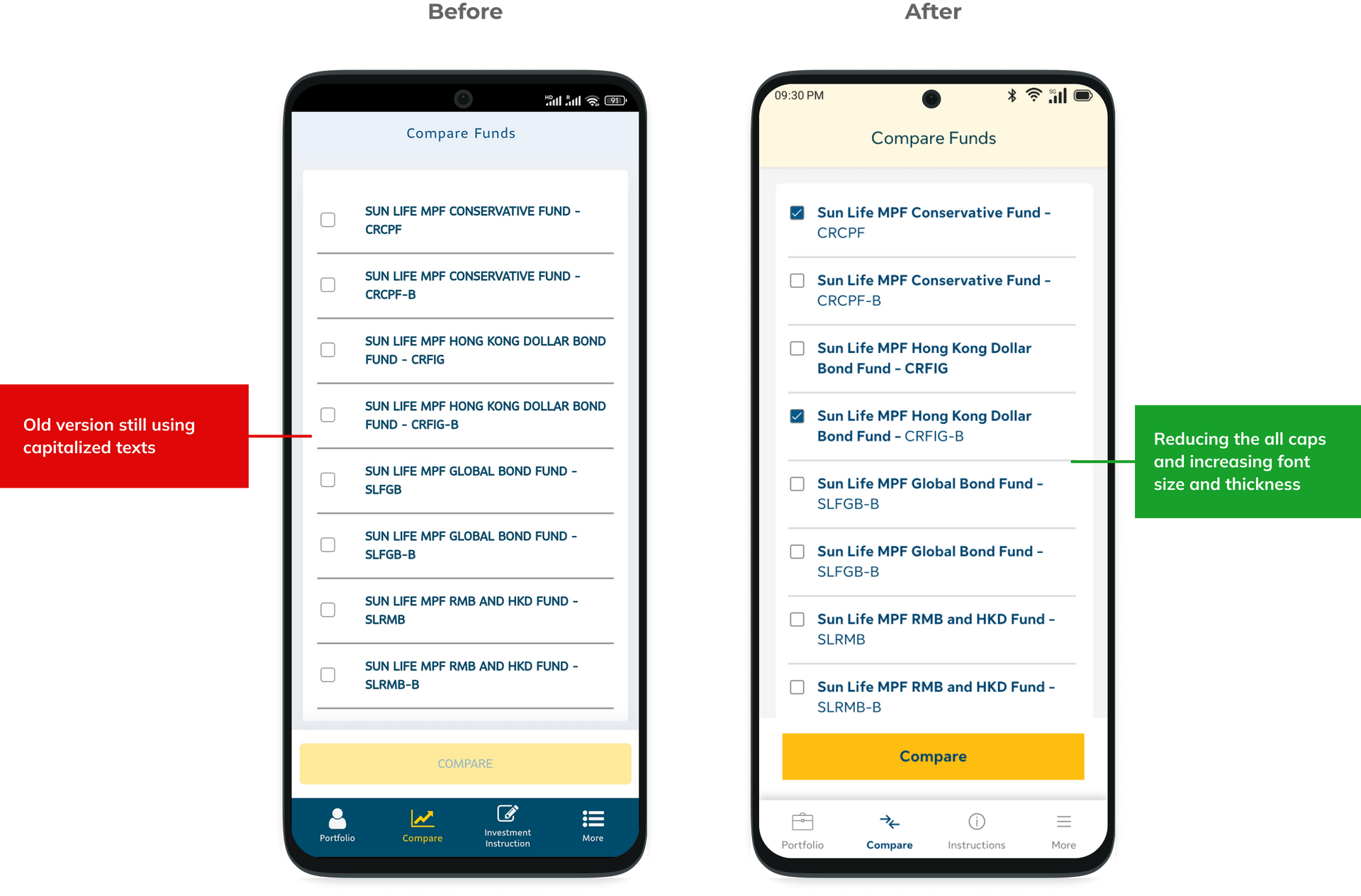

Compare Funds

Compare fund alignment is retained, but the text is improved and readable. Users can easily compare investment options and make informed decisions.

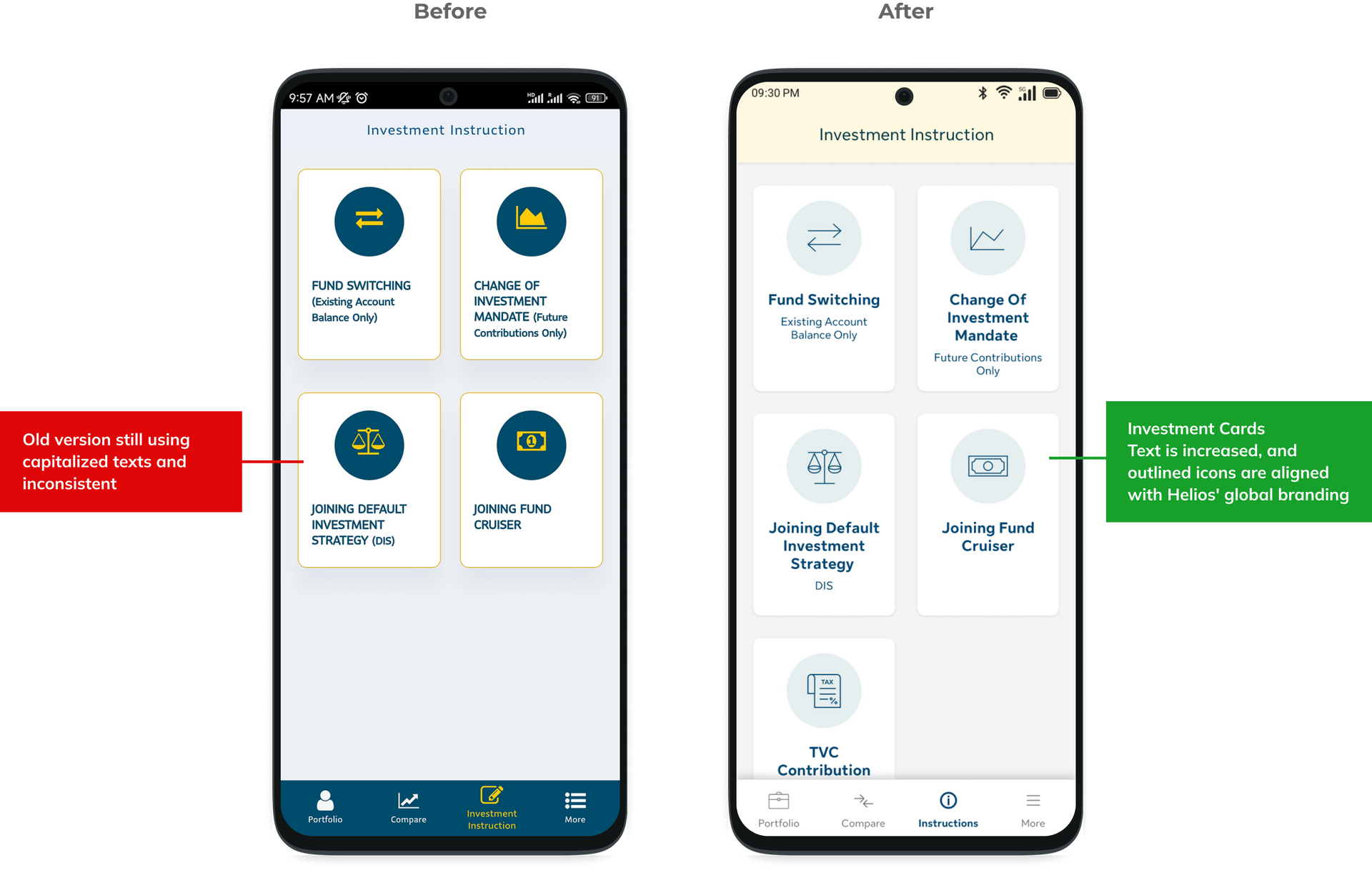

Investment Instruction

Investment instructions have simplified, featuring a step-by-step process and an intuitive interface that allows users to complete transactions effortlessly.

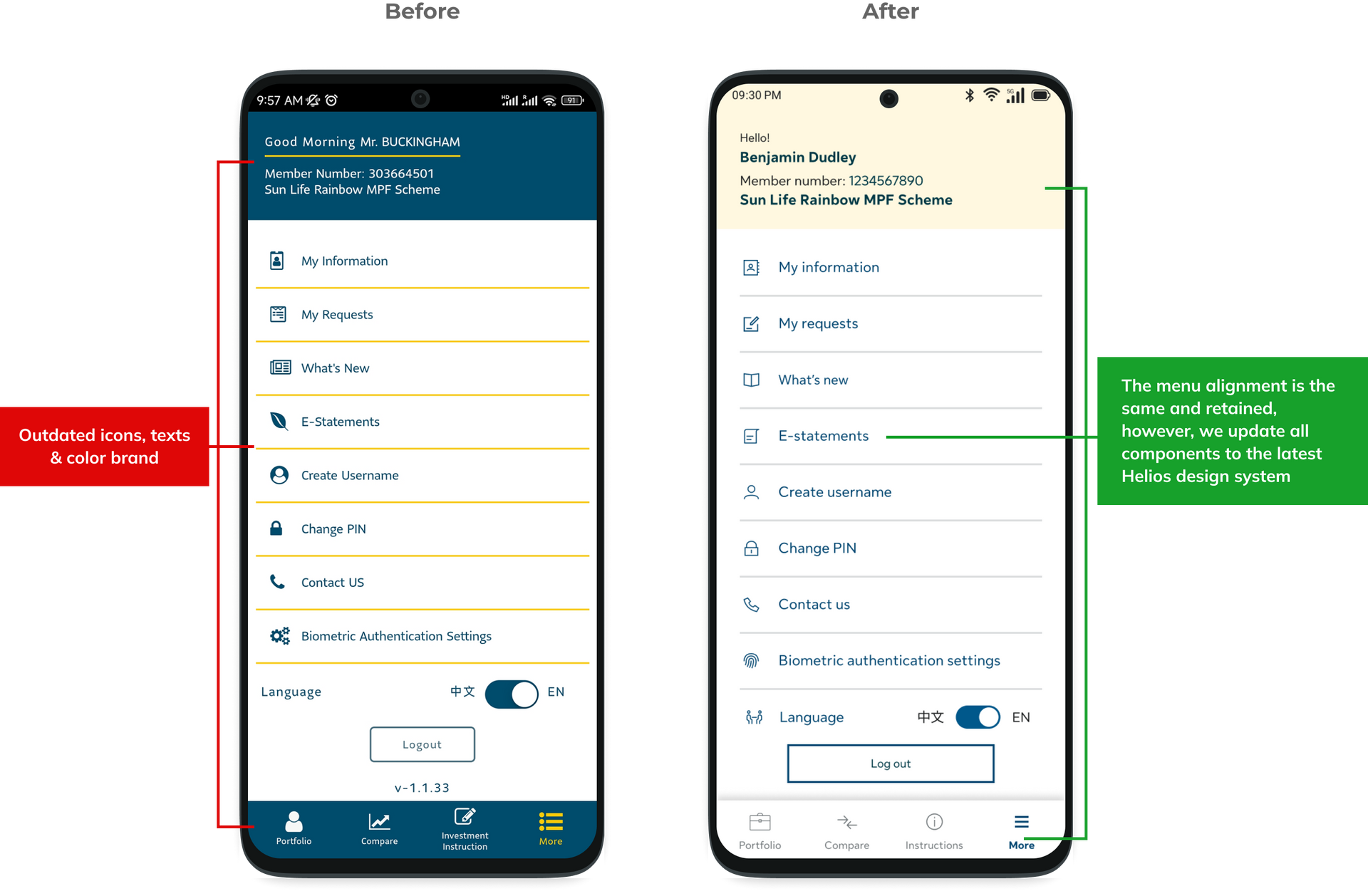

More Options

This reduction in clutter enhances usability, enabling users to easily navigate the platform and find the functions they need.

By Fund

The By Fund feature is now more user-friendly, with intuitive filters, visual fund comparisons, and clear categories, making it easier for users to evaluate and choose funds according to their needs.

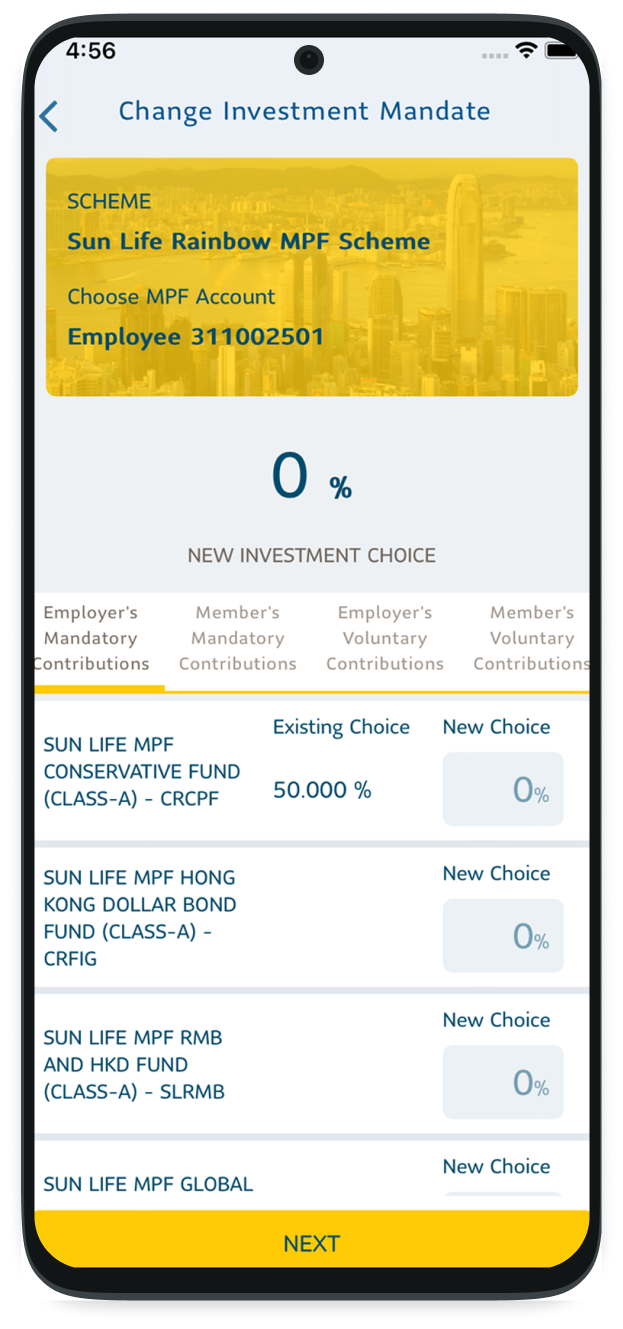

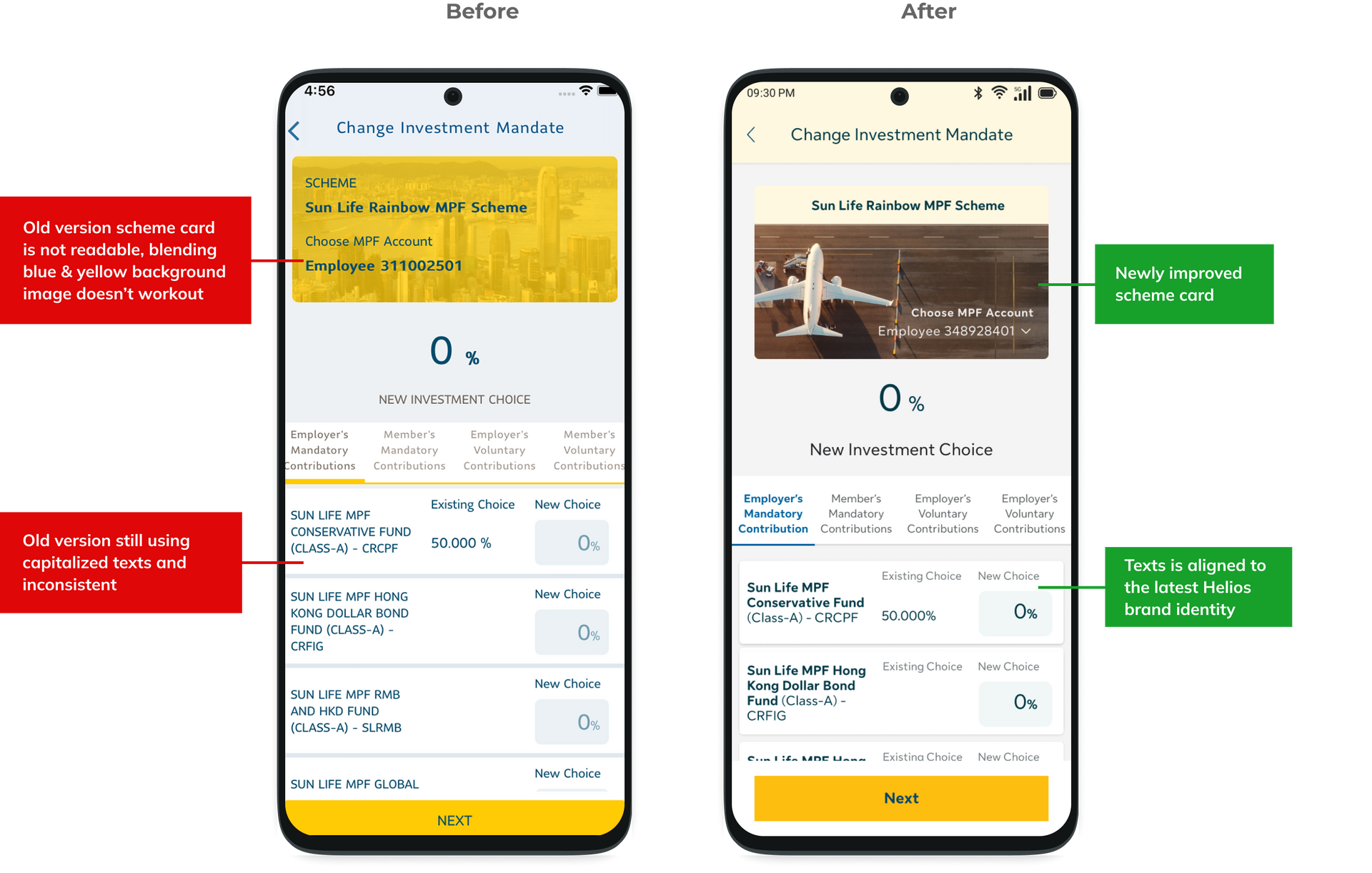

Change Investment

The investment mandate has been optimized into a straightforward, step-by-step process with real-time feedback and simplified navigation, resulting in a significantly improved overall user experience.

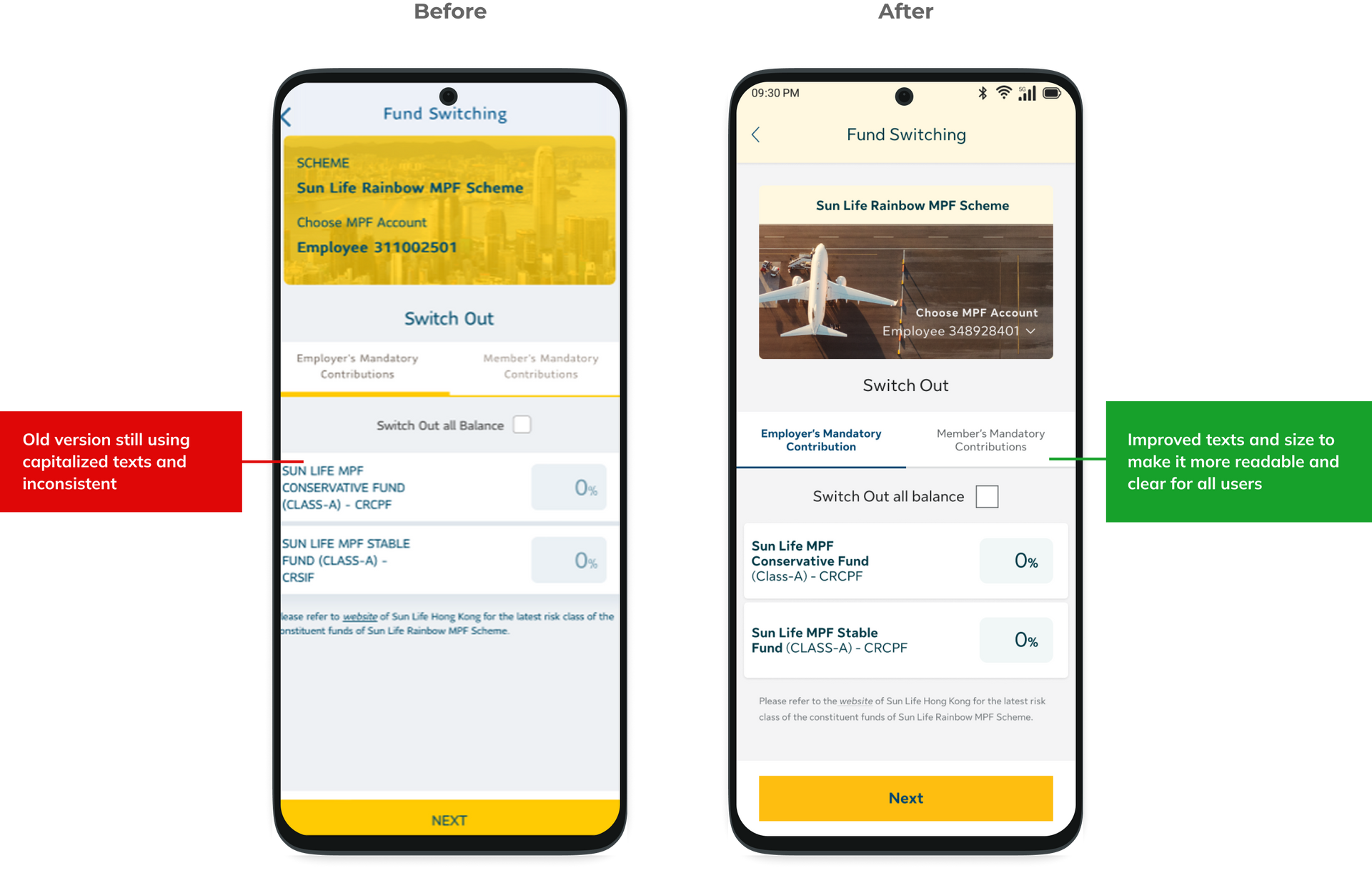

Fund Switching

Fund switching is now supported by a real-time tracking dashboard, allowing users to track the status of their fund switches and make changes before the final execution, which enhances control and certainty over their investments.

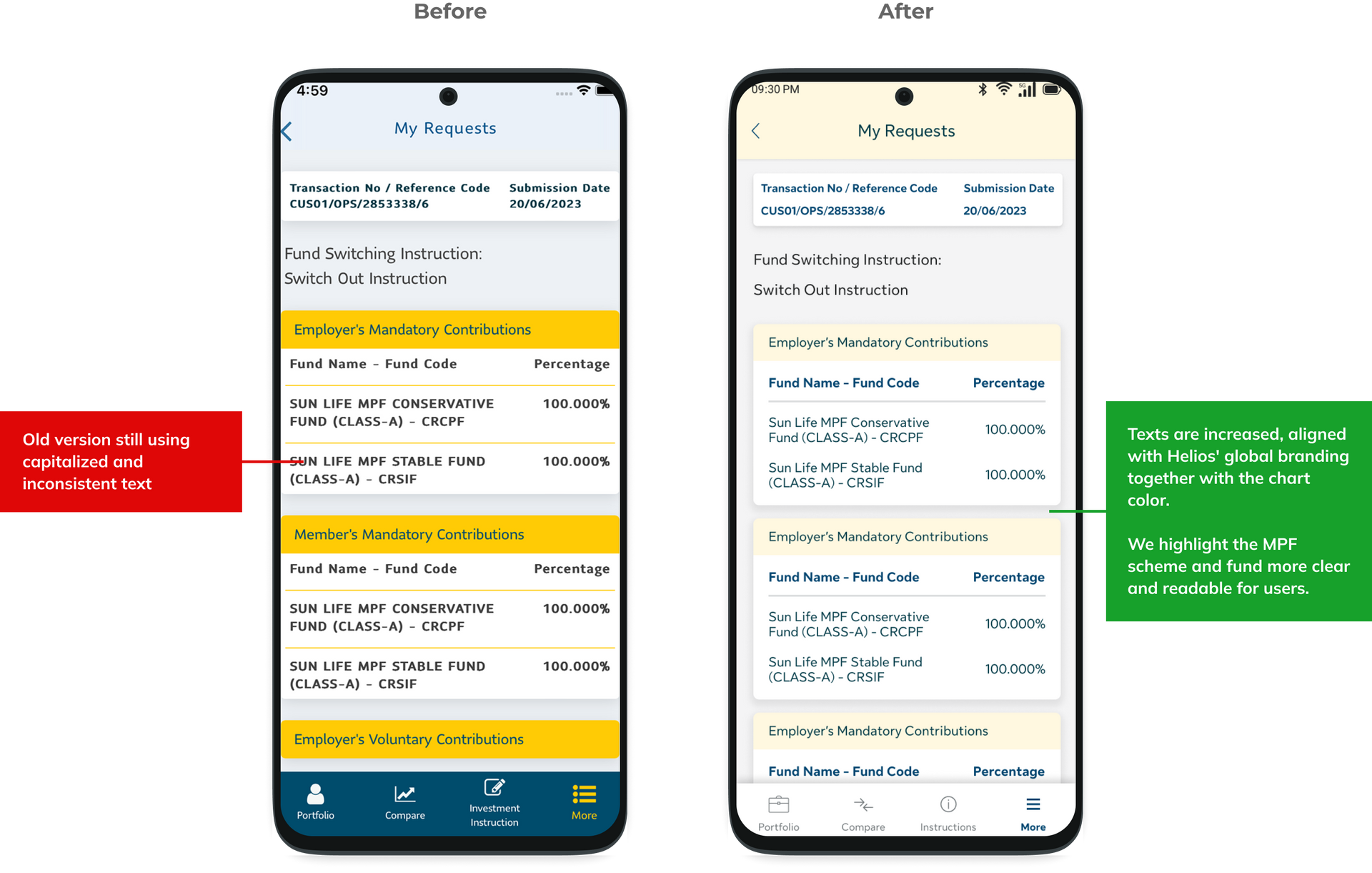

My Request

Offers users the ability to view, track, and modify requests in real-time, reducing the need to contact customer service and improving transparency around pending actions.

Moving forward

The journey doesn't end with the rebrand. We are committed to continuously enhancing the user experience, expanding self-service features, and keeping pace with evolving security needs. Future enhancements will focus on further simplifying the user journey, expanding integration capabilities, and providing more personalized tools for users to manage their MPF with ease. With these goals in mind, we aim to maintain leadership in the MPF sector and build long-lasting trust with our growing user base.