Welcome to modern renting.

Our mission is to make renting a seamless and stress-free experience for everyone. Discover the perfect new place and obtain what you and your family deserve.

Improve your living space and start living your best life today!

Overview

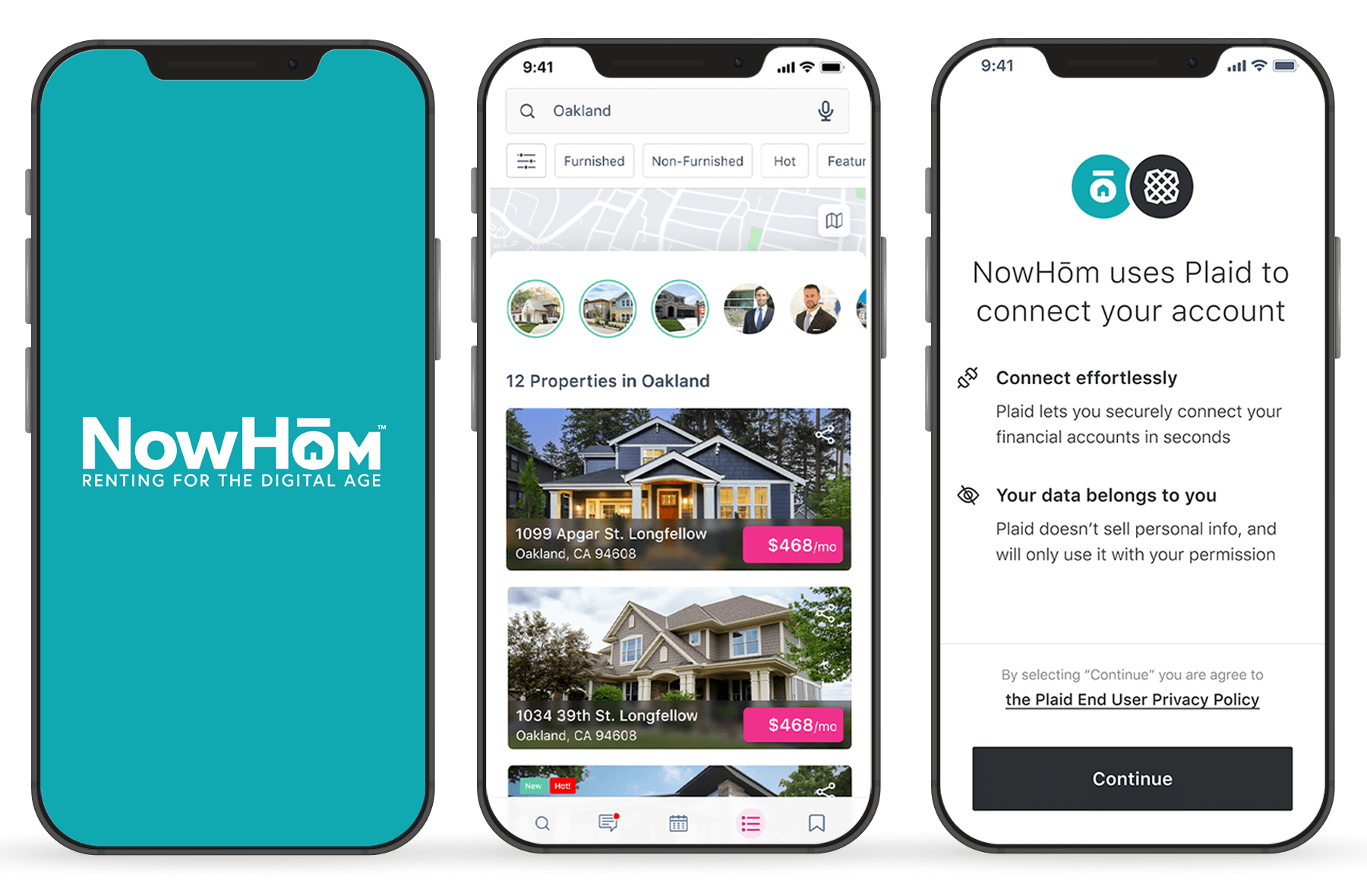

Design a user-centric digital platform for long-term rental service, focusing on accessibility, usability, and seamless experience for renters and landlords. The app aims to streamline the entire rental process, from property search, virtual tours, lease signing, and integrated payment systems.

Industry :

- Real Estate Long-term rental service

Business Model :

- Rental B2C Marketplace

- B2B Property Management

- Free to use Premium Features

Platform :

- Mobile iOS and Android

Project Timeline :

- 9 months

My role

I'm the lead product designer for this project. From end-to-end research, design, and development. I collaborated with a multi-functional team:

- Peter Cheng (Delivery Manager)

- Ann Nolasco (Product Manager)

- Russel Kinney (Business Analyst)

- TJ Figueroa (Product Designer)

- Sonjay Sarmeinto (Sr. Software Engineer)

- Ralph Evans (Full-Stack Developer)

We started NowHom in August 2019, but it faced a 6-month halt due to COVID-19 and US restrictions. Fortunately, we resumed the project virtually, working from home until we successfully launched the mobile app in January 2021.

Background

NowHom is a proptech company based in California, USA, founded by Beach Cities Investments, Inc. Established in 2020.

NowHom aims to revolutionize the rental experience by integrating real estate and financial technology, making the process more accessible and efficient for tenants, landlords, and property managers.

Understanding the problem

NowHom's main issue is the inefficient, fragmented, and unclear nature of the current rental market. Tenants waste time and face surprise fees. They also cannot build credit, even when they make their payments on time. Landlords encounter fraud, empty units, operational problems, and legal risks. The system lacks transparency and trust, which frustrates both sides of the market, leaving them feeling underserved.

Lack of qualification transparency

Renters don’t know if they meet income, credit, or background criteria until after paying fees.

Inefficient application process

Each property or landlord requires a separate application, ID upload, income verification, references, and contact forms.

Rent doesn’t build credit

Rent is usually a renter’s largest monthly expense, but most credit bureaus don’t recognize it. Without reporting to Experian, renters don’t build credit even if they pay on time.

Unqualified leads

Many inquiries are from tenants who fail to meet income or credit requirements.

Vacancy loss

Many inquiries are from tenants who fail to meet income or credit requirements.

Rent collection and reconciliation

Without integrated rent portals, tracking payments and balancing books takes hours weekly. Autopay is uncommon; late fees and reminders must be issued manually.

Research and findings

Highlight achievements by the numbers

We invited 18 participants and conducted a survey and interviews

12

Professionals, students, and families

6

Landlords, property managers, and property agents

90%

Short heading goes here

90%

Short heading goes here

Highlight achievements by the numbers

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design.

90%

Short heading goes here

90%

Short heading goes here

Solution

Maintaining multiple tenants’ and landlords’ problems like finding a suitable property and signing a lease within a platform they do not need to meet physically to sign a lease.

Renters / Tenants

Verified Listings and Real-Time Availability

NowHom ensures that all listings are verified either by landlords, property managers, or through direct integration with Property Management Systems (PMS). Listings are updated in real time to reflect accurate availability and pricing.

Impact

Tenants can trust that the listings they see are correct. This takes away the hassle of dealing with outdated or fake listings.

Instant Pre-Qualification

Renters can quickly check if they qualify for properties with a pre-qualification tool that uses soft credit checks and income verification through a bank or payroll. This gives renters an immediate response on whether they meet the landlord's criteria, including income and credit requirements.

Impact

They can easily find listings that fit their financial profile and skip application fees for properties that don't match their qualifications.

Virtual Tours and Self-Serve Scheduling

Renters can book virtual tours directly through the app, allowing them to tour properties remotely via live video walkthroughs, 3D tours, or recorded content. In-person tours can also be scheduled with automatic reminders and confirmations.

Impact

Renters can view properties at their convenience, eliminating the need for complicated scheduling. Remote tenants can also explore properties without being there in person.

Rent Payment Automation

Renters can pay their rent using ACH, debit, credit card, or mobile wallet payments. NowHom also lets users set up autopay, along with reminders and late-fee automation.

Impact

Renters can conveniently pay rent on time and see improvements in their credit scores with regular payments.

Landlords / Property Managers

Verified Listings & Marketplace Management

Landlords and property managers can upload listings, manage availability, update pricing, and make sure that only verified units are displayed. Listings sync automatically with real-time availability to avoid double bookings.

Impact

Provides consistent and accurate information for prospective tenants, reducing time spent on manual updates.

Automated Screening & Pre-Screening

NowHom’s automated screening process pre-qualifies tenants based on customizable criteria (credit score, income, background checks). Landlords can define their own criteria for each listing.

Impact

Saves landlords time by filtering out unqualified applicants at the beginning, this leads to a smoother screening process.

Integrated Rent Collection & Financial Tools

Landlords can collect rent payments directly through the app; It offers flexible payment options like ACH, card payments, or digital wallets. The platform keeps track of all payments, generates automatic receipts, and notifies landlords about late payments or missed rent.

Impact

Rent collection is automated and secure, with landlords having a full overview of all financial transactions in real-time.

Financing & Flexible Payment Options

Renters can use flexible financing options to pay rent, such as splitting payments into installments or accessing a “rent now, pay later” feature.

Impact

Provides renters with more financial flexibility, especially for those experiencing temporary cash flow issues.

Secondary research

NowHom's

objectives are centered around providing a seamless, efficient, and socially responsible rental experience for both tenants and landlords. The company aims to achieve its goals by focusing on innovation, community impact, and platform growth. Below are the key objectives of NowHom:

Impact

NowHom’s objectives are designed to achieve its business goals by focusing on both enhancing user experience and driving sustainable growth. These objectives address the needs of tenants, landlords, and the broader community, while also ensuring the platform's continued success in the real estate and proptech sectors.

40%

Simplify the Rental Process

NowHom aims to make finding and securing rental properties straightforward and user-friendly. Their platform offers features like virtual walkthroughs and a three-step application process to streamline the experience for tenants.

25%

Enhance Tenant Accessibility

The platform provides tools such as credit boosting and the ability to "lock in" a property, increasing the chances of securing a desired rental, even for those with less-than-perfect credit.

20%

Supporting Landlords and Property Mangers

NowHom offers landlords and management companies tools to fill vacancies more efficiently by connecting them with pre-qualified tenants, thus reducing downtime between tenants.

Target Market Users

Renters

- Professionals, students, and families

- Renters who would rather have virtual tours, rather than meet in person

Landlords

- Property owners looking to expand their tenant base digitally

- Landlords seeking to easily list and manage properties

- Real estate experts managing property and assisting clients find rental houses

Our process

To understand about NowHom’s background, market space, and users, I started by conducting research with the following goals:

Research Goals

Understanding consumer behavior and demographics is essential to developing a successful rental property app, but so is knowing how emerging technologies like virtual reality (VR) can enhance the user experience. The purpose of this study is to thoroughly examine these elements, determining user requirements, expectations, and the ways in which virtual reality (VR) can be used to improve property search and engagement.

Consumer Behavior

- 22% of people feel that the pre-qualification application has too many requirements, making it difficult to apply for rent.

- There’s no denying the COVID-19 pandemic changed business as we know it. But there’s no evidence to suggest it hindered short-term renters (STRs).

- Demand for STRs is higher than it was in pre-pandemic times—and so is revenue.

- STR demand is up 23.8% from 2020. And even though occupancy rates have slightly declined due to an uptick in supply, revenue is still 21.5% higher than it was this time last year and 60.3% higher than it was before the pandemic.

Demographics

- Americans who plan to buy or rent a property in the next 12 months in 2018, by age: 33.33% of respondents 18-29 years; 34.55% 30-49 years; 22.99% 50-64 years

- 3.13 percent of respondents aged 18 to 29 years stated that they are short-term renters in the past 12 months; 38.57% for 30-49 years; 25.2% for 50-64 years for long-term renters or homeowners.

Virtual Reality (VR)

- Nowadays, new tech is constantly being introduced and changing the face of industries. The most recent technological developments in real estate are virtual tours and virtual reality (or VR).

- VR allows you to view a house without having to physically move.

- 95% of home buyers use the Internet to look for homes.

- 51% of people buy homes that they found online, so adding VR to this seems like the obvious next step

- 71% of Millennials are positive about the use of VR, this is unsurprising as most Millennials are quick to adapt to new technologies. On the other hand, older generations might take a bit more convincing

- 62% of Americans now choose their real estate agency which one provides 3D virtual reality tours

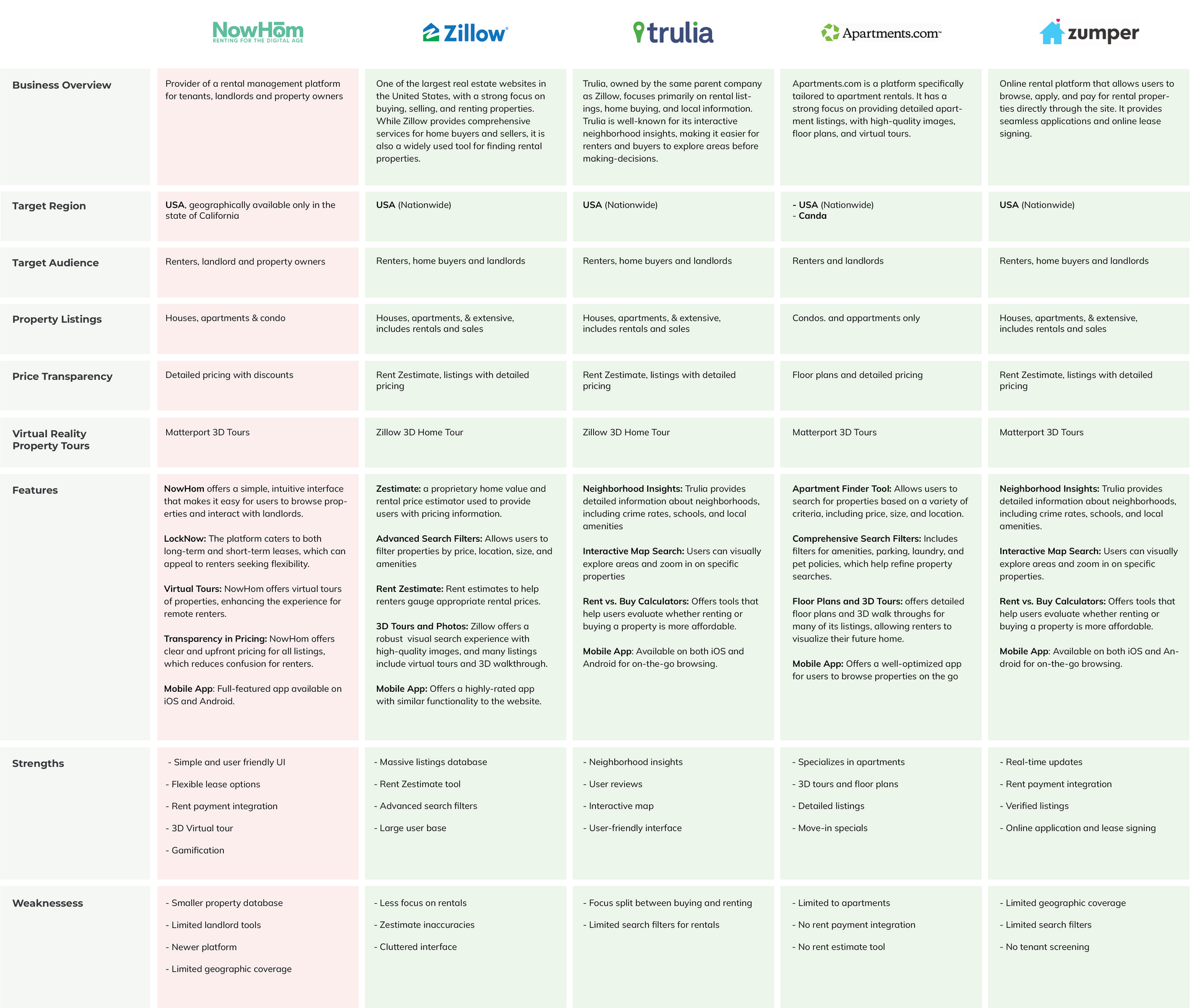

Competitive Analysis

After learning more about the industry, I wanted to take a closer look at NowHom's competitors and how they’re helping their users/tenants, and how they are able to rent and passed some verification requirements. Through my market research, I identified some top direct and indirect competitors within the industry: Apartments.com, Trulia Rentals, Redfin, and Airbnb. Direct competitors are real estate-focused similar to NowHom, while indirect competitors aren’t focused solely on long-term rent. Exploring each of their apps, I evaluated the strengths and weaknesses of each to see how Homely could fill in any gaps moving forward.

Persona

Malcolm Stuart

24 Years Old

Student at UCLA

Works at Antler Cafe

Annual Income:

$18,890

+ $8,000 Commission

Own a Pet

No Kids

Fair Credit

Social Techie

Randy Van Veen

32 Years Old

Consulting Manager

Rimini Street

Annual Income:

$88,900

Married

Three (3) Children

Bad Credit

Tech Savvy

James Miller

41 Years Old

Business Owner

Drain Right Services

Annual Income:

$206,420

Single

One Child

Good Credit

Basic Tech User