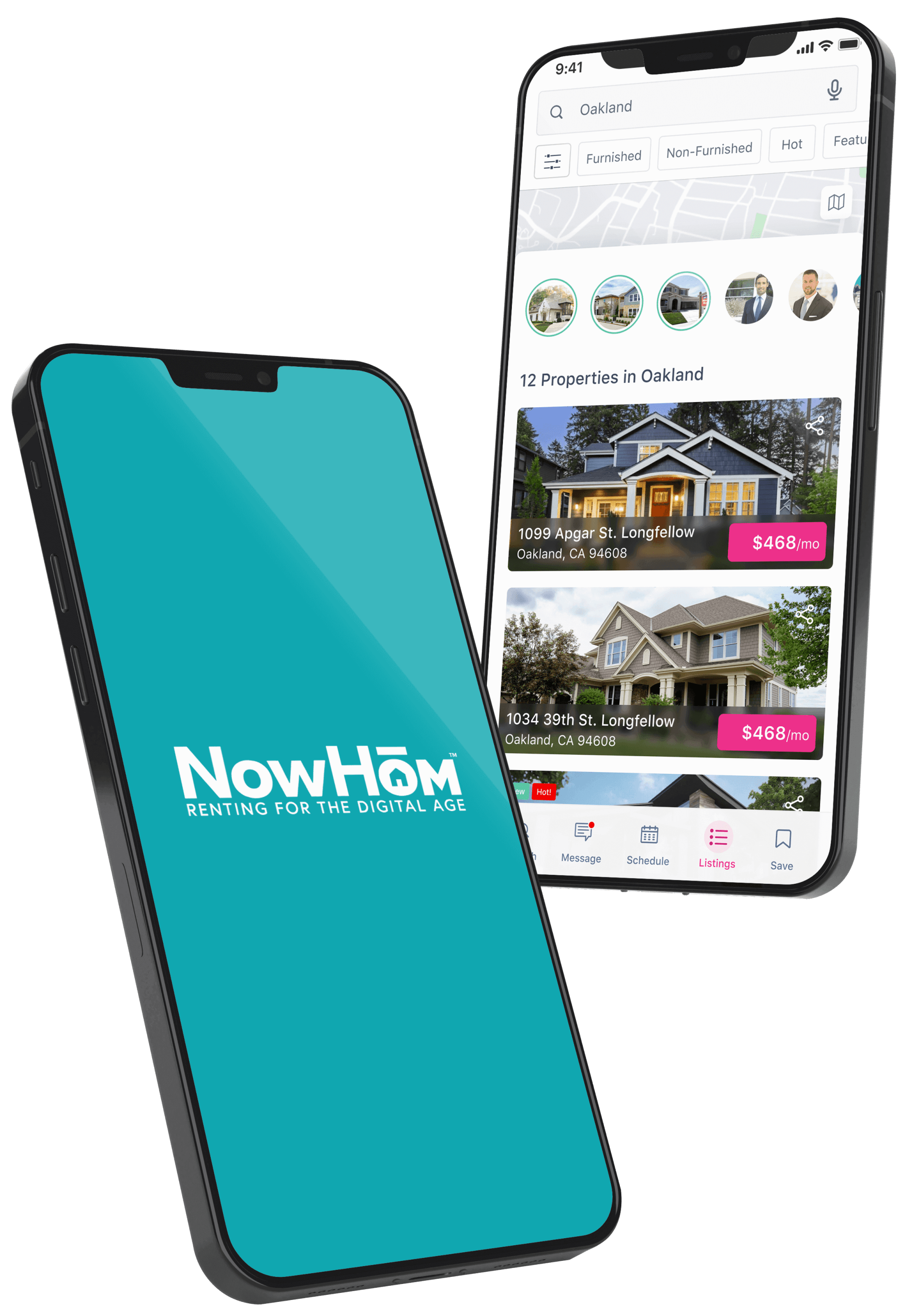

NowHom

Welcome to modern renting. NowHom is a rental search platform designed for short-term and long-term urban renters in mind. Real estate is always hot, that's why we're creating and improving on the most essential features; LockNow property, Matterport for virtual viewing of the property, Home Loan, evaluate accounts through Credit Score.

We turn property classified ads and payphones into digital, that's we created NowHom, the first-ever virtual 3D real estate for a better wider audience and close-on properties faster.

Overview

Challenge

NowHom is the first-time app to develop and compete in the digital rental world. Design a new rental app to guide users while exploring properties across the state of California. An app that investors can expand real estate investment strategies that attract users/tenants.

Solution

- Create and design an app that helps users explore and navigate properties with their own preferences.

- Preference that composes map-view and map-based search.

- Most trusted and comprehensive listings, verified by the landlord, contact information, VR for 3D runtime, real-time updates, and user reviews.

- Display interface for Matterport, and non-Matterport premium.

- A unique brand identity that reflects NowHom and LockNow attributes.

Role

- UX Research

- Conduct User Testing

- Create Wireframe and Prototype

- Identify Accessibility Issues

Project Duration

- 6 Months

Tools

- Jira

- Miro

- Figma

- TryMyUI

Research

To understand about NowHom’s background, market space, and users, I started by conducting research with the following goals:

- Understand the market trends of rental industry

- Identify NowHom's target market

- Identify NowHom's competitors and evaluate their strengths and weaknesses

- Understand the experiences of every tenant who have been stayed for long-term and short-term property rental

- Discover goals, needs, motivations, and frustrations of every users or tenant

Market Research

One of the initial challenges facing the market analyst is to define the boundaries of the property’s market area (or the trade area in a retail market study). In reality, properties often have two market areas—one from which the majority of potential tenants or buyers will be drawn and another from which the key competitors are located.

Consumer Behavior

- Identifying what previous customers (buyers or tenants) like and dislike about a the property;

- 22% of people feel that the pre-qualification application has too many requirements, making it difficult to apply for rent.

- There’s no denying the COVID-19 pandemic changed business as we know it. But there’s no evidence to suggest it hindered short-term renters (STRs).

- Demand for STRs is higher than it was in pre-pandemic times—and so is revenue.

- STR demand is up 23.8% from 2020. And even though occupancy rates have slightly declined due to an uptick in supply, revenue is still 21.5% higher than it was this time last year and 60.3% higher than it was before the pandemic.

Demographics

- In 2017, almost 30% of renters are 20-34 years old students.

- Americans who plan to buy or rent a property in the next 12 months in 2018, by age: 33.33% of respondents 18-29 years; 34.55% 30-49 years; 22.99% 50-64 years

- 3.13 percent of respondents aged 18 to 29 years stated that they are short-term renters in the past 12 months; 38.57% for 30-49 years; 25.2% for 50-64 years for long-term renters or homeowners.

Virtual Reality (VR)

- Nowadays, new tech is constantly being introduced and changing the face of industries. The most recent technological developments in real estate are virtual tours and virtual reality (or VR).

- VR allows you to view a house without having to physically move.

- 95% of home buyers use the Internet to look for homes.

- 51% of people buy homes that they found online, so adding VR to this seems like the obvious next step

- 71% of Millennials are positive about the use of VR, this is unsurprising as most Millennials are quick to adapt to new technologies. On the other hand, older generations might take a bit more convincing

- 62% of Americans now choose their real estate agency which one provides 3D virtual reality tours

Competitive Analysis

After learning more about the industry, I wanted to take a closer look at NowHom's competitors and how they’re helping their users/tenants, and how they are able to rent and passed some verification requirements. Through my market research, I identified some top direct and indirect competitors within the industry: Apartments.com, Trulia Rentals, Redfin, and Airbnb. Direct competitors are real estate-focused similar to NowHom, while indirect competitors aren’t focused solely on long-term rent. Exploring each of their apps, I evaluated the strengths and weaknesses of each to see how Homely could fill in any gaps moving forward.

Description

Provider of a rental management platform for tenants, owners, and landlords.

Founded Year

2004

Location

San Francisco United States

Company Stage

Series D

Total Funding

-

Funding Round

2

Latest Round

Series D $92 Million, July 2020

Investor Count

2

Top Investors

Global Invest Management, Beach Cities Investment

Growth Score

42/100

Overall Rank

2nd

Description

Online listing platform to find commercial properties. Platform enables users to browse listings.

Founded Year

1983

Location

Chicago, United States

Company Stage

Public

Total Funding

-

Funding Round

2

Latest Round

Conventional Debt, $60M, Nov 28, 2018

Investor Count

2

Top Investors

Global Invest Management, Beach Cities Investment

Growth Score

42/100

Overall Rank

2nd

Description

Provider of an online property listing platform to buy or sell residential properties.

Founded Year

2007

Location

Singapore, Singapore

Company Stage

Series D

Total Funding

$642 Million

Funding Round

4

Latest Round

Series D, $147M, Aug 26, 2021

Investor Count

5

Top Investors

TPG, Naya Capital, Akaris Global Partners, REA Group, KKR

Growth Score

77/100

Overall Rank

2nd

Description

The platform enables users to register and browse for properties by applying the location filter.

Founded Year

2004

Location

San Francisco United States

Company Stage

Series D

Total Funding

-

Funding Round

2

Latest Round

Series D $92 Million, July 2020

Investor Count

2

Top Investors

Global Invest Management, Beach Cities Investment

Growth Score

42/100

Overall Rank

2nd

Proto-Persona.

Malcolm Stuart

24 Years Old

Student at UCLA

Works at Antler Cafe

Annual Income:

$18,890

+ $8,000 Commission

Own a Pet

No Kids

Fair Credit

Social Techie

Randy Van Veen

32 Years Old

Consulting Manager

Rimini Street

Annual Income:

$88,900

Married

Three (3) Children

Bad Credit

Tech Savvy

James Miller

41 Years Old

Business Owner

Drain Right Services

Annual Income:

$206,420

Single

One Child

Good Credit

Basic Tech User